The Indian BFSI sector has been quietly reshaping its tech backbone over the last few years. Digital transactions are soaring, fraud patterns keep mutating, and regulators expect tighter control over everything—from uptime to data handling. With this constant pressure, financial institutions are rethinking where their core systems should live.

And one pattern stands out: Tier III datacenters are gradually becoming the default home for critical banking workloads.

If you look around, most of the heavy lifting—core banking, payments, settlement engines, regulatory reporting, even fraud analytics—now sits inside Tier III facilities. They’ve become the safe, sturdy middle ground the financial sector trusts.

So, why Tier III? Because BFSI wants an infrastructure that doesn’t flinch

1. Redundancy That Keeps Banking ALive

Tier III setups offer N+1 redundancy across power, cooling, and network pathways. It basically means there’s always a spare route, a spare system, a spare backup ready to kick in.

For BFSI, where even a 10-second outage can freeze an ATM network or disrupt UPI flows, that’s not a luxury—it’s oxygen.

You get:

- Maintenance without shutdowns

- Fewer single-point failures

- A stable base for high-density workloads like fraud monitoring and transaction processing

No wonder many CIOs quietly agree that Tier III has become the “minimum acceptable” environment.

2. Matching India’s Regulatory Pulse

Banks and insurance players live under a microscope. Between RBI, IRDAI, and MeitY guidelines, the expectations are crystal clear:

- Keep data within India

- Maintain strict uptime

- Track and control every access point

- Ensure multi-zone protection

- Maintain auditable, tamper-proof systems

Tier III datacenters naturally support this ecosystem with their structured zones, controlled access, predictable uptime, and environment stability. For BFSI teams, this reduces the maze of compliance overhead and lets them focus on improving services instead of babysitting infrastructure.

3. Fueling Digital Banking and AI-Heavy Workloads

Modern BFSI tech stacks aren’t simple anymore. You’ve got:

- API-based banking

- Digital onboarding

- Real-time settlements

- AI-driven fraud detection

- Personalization engines

- Cloud-native core banking upgrades

These workloads crave consistency—steady power, stable temperature, reliable hardware, and smooth performance under load. Tier III facilities offer all of that without wobbling.

As digital payments grow and fintechs push innovation faster, Tier III datacenters give BFSI teams the confidence that their infrastructure won’t become a bottleneck.

4. The Big Colocation Wave in Indian BFSI

There’s a noticeable shift happening: banks are moving away from running everything in-house. The cost, the manpower, the monitoring—it’s too heavy.

Colocation is filling that gap, especially inside Tier III environments.

Why? Because colocation offers:

- Controlled capex with predictable opex

- Space for high-density AI or analytics racks

- Stronger security without expanding internal facilities

- Faster rollout of digital products

- Simplified disaster recovery designs

5. Security That Keeps Pace with Threats

Security sits at the center of every BFSI decision. Tier III datacenters bring multiple layers of defense:

- Biometric access

- 24×7 surveillance and SOC monitoring

- Segregated network lanes

- Compliance-ready logs

- Fire suppression and climate-controlled zones

- Redundant sites for Disaster Recovery

6. Cost Efficiency Because Standardization Works

One underrated perk of Tier III setups is cost discipline. When providers run at scale, customers naturally benefit.

BFSI clients get:

- Shared power and cooling investments

- Physical separation without huge infrastructure cost

- Smaller internal teams needed for upkeep

- Predictable pricing for compute and network

What offering does ESDS BFSI Community Cloud offers

ESDS provides BFSI Community cloud with regulation cloud environment built specifically for Indian banks, and also other financial institutions.

- Compliance & Sovereign – it satisfies data localization norms and regulatory mandates, giving institutions freedoms about data residency and audit readiness.

- Vertical auto-scaling & cost-efficient mode – Built on ESDS patented eNlight Cloud platform, the cloud can automatically scale compute and storage resources as demand fluctuates.

- End-to-End Services – From core banking systems to digital payment rails, regulatory reporting, document management, disaster recovery, and even newer services like AI-based analytics.

- GPU-as-a-service – ESDS’ GPU-as-a-Service (GPUaaS) platform provides banks, NBFCs and fintech players access to high-powered GPU clusters in a secure, compliant environment

ESDS BFSI Cloud bridges the gap between regulatory compliance, cost-sensitivity, and modern banking needs.

Wrapping it up

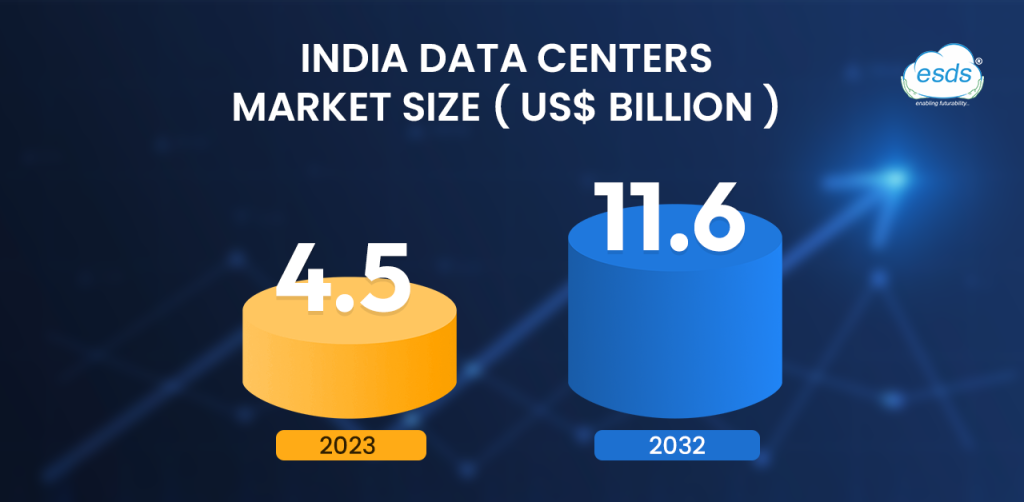

India’s BFSI ecosystem is standing at an interesting crossroads. Transaction volumes are rising, fraud is getting trickier, and digital infrastructure demands are climbing fast. In this setting, institutions need datacenters that stay solid—no matter how unpredictable things get.

Tier III facilities deliver that stability, which is why they’re rapidly becoming the go-to foundation for secure banking IT. And when paired with BFSI colocation and community cloud setups, the whole architecture becomes even stronger and more future-ready.

This shift isn’t just about tech. It’s a strategic move, one that sets the tone for how India’s financial sector will operate in the years ahead.

FAQs

1. Why is Tier III hosting preferred for BFSI?

Because it offers reliable N+1 redundancy, strong uptime, and compliance support. It fits mission-critical workloads like payments, core banking, and regulatory systems.

2. How does BFSI colocation help with regulations?

Tier III colocation providers support strict access controls, data localization, uptime commitments, and continuous monitoring.

3. What’s the purpose of a BFSI Community Cloud?

It gives banks and financial institutions a ready-made, policy-aligned environment for apps, data, and analytics. It also speeds up deployment and blends smoothly with Tier III setups.

4. Is Tier III suitable for analytics or AI-heavy banking workloads?

Tier III facilities handle high-density racks and deliver consistent power and compute performance, supporting fraud analytics, predictive models, and real-time engines.

5. How does Tier III strengthen secure banking IT?

Through layered physical security, network segregation, continuous monitoring, and redundant infrastructure—all designed to keep sensitive financial data safe and available.

Recent Comments